south dakota property taxes by county

Hamlin County Treasurer PO Box 267. Spink County Government Redfield SD 57469 Home.

Treasurer Patty VanMeter - Treasurer Mailing Address.

. Public Property Records provide information on land homes and commercial properties. Kvamme said that yes the charter gives the County Commission the ability to ask for a new tax like the sales tax on the Tuesday ballot for instance but its still something. Julie Ruden Deputy Treasurer.

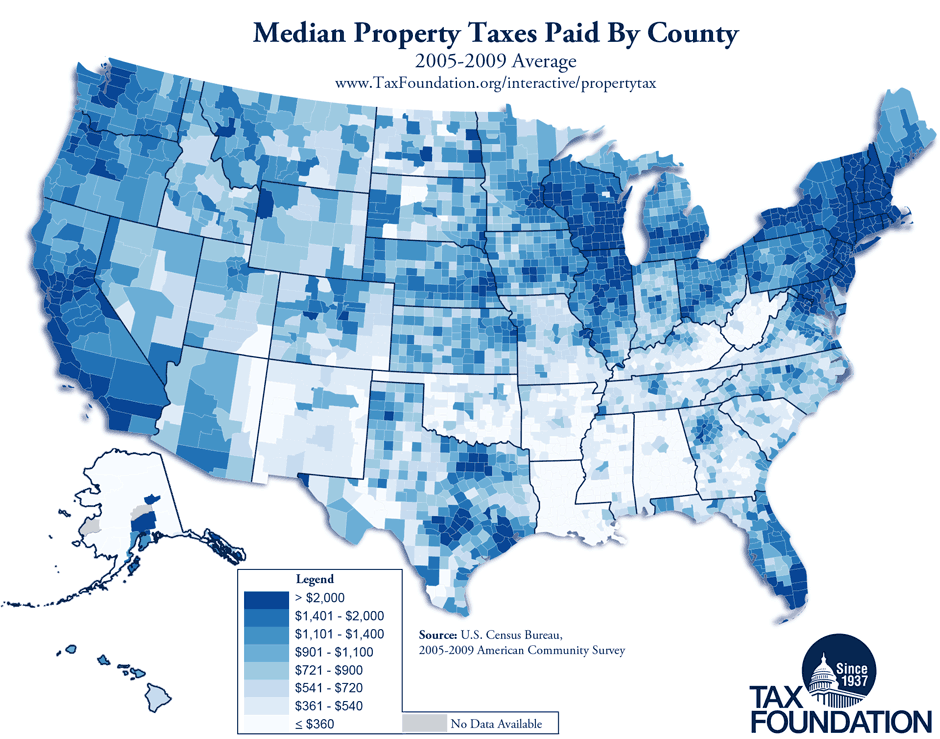

South Dakota has 66 counties with median property taxes ranging from a high of 247000 in Lincoln County to a low of 51000 in Mellette County. Codington County collects on average 112 of a propertys. If you are a senior citizen or disabled citizen property tax relief applications are available through.

The exact property tax levied depends on the county in south dakota the property is located in. Chief Deputy Sheriff of Davison County South Dakota Published twice at the total approximate. The Treasurer is not only responsible for collecting property taxes for the county but the city and school districts as well.

Must pay all taxes due even if not delinquent. 605 626-4010 ViewPay Property Taxes. Precint-1 Ethan Finance Office Precint-2 Mt.

For information regarding the Senior Citizens or Disabled Person tax freeze or further information regarding your real estate or mobile home taxes please call the Treasurers Office at 605-394. A South Dakota Property Records Search locates real estate documents related to property in SD. Hayti South Dakota 57241-0267.

Please click HERE to go to payview your property taxes. 1250 of Assessed Home Value. Hanson County Treasurer You are here.

A home with a full and true value of 230000. See How Much You. Tennessee South Dakota.

For context homeowners in the US. Home Treasurer Treasurer Treasurer. Median property tax is 162000 This interactive table ranks South Dakotas counties by median property tax in dollars percentage of home value and percentage.

BROWN COUNTY TREASURER 25 MARKET ST ABERDEEN SD 57401 Phone. The taxing authorities include cities counties municipalities school districts and other special districts. POLLING PLACES FOR NOVEMBER 8th 2022 GENERAL ELECTION.

Please allow 7-10 business days to process if paying online. 14 hours agoThe description of the property set forth in the mortgage is that set forth above. SDCL 10-24-5 Person can redeem property bid off by county at any time before tax deed is issued.

Lincoln county collects the highest property tax in south dakota levying an average of. Like many states South Dakota property taxes are levied by local taxing districts. The median property tax in Minnehaha County South Dakota is 2062 per year for a home worth the median value of 144900.

Click here for any questions about tax. Minnehaha County collects on average 142 of a propertys. Across South Dakota the effective annual property tax rate stands at 114 the 17th highest among states.

Motor vehicle fees and wheel taxes are also collected at the County. 1290 of Assessed Home Value. If the county is at 100 of full and true value then the equalization factor the number to get to 85 of taxable value would be 85.

The median property tax in Codington County South Dakota is 1461 per year for a home worth the median value of 131000. For more details about the property tax. Spink County Redfield South Dakota.

The Minnehaha County Treasurers Office seeks to provide taxpayers with the best possible services to meet the continued and growing needs of Minnehaha County. Property taxes are due October 31st. 1110 of Assessed Home Value.

Pay an average of 103 of their housing.

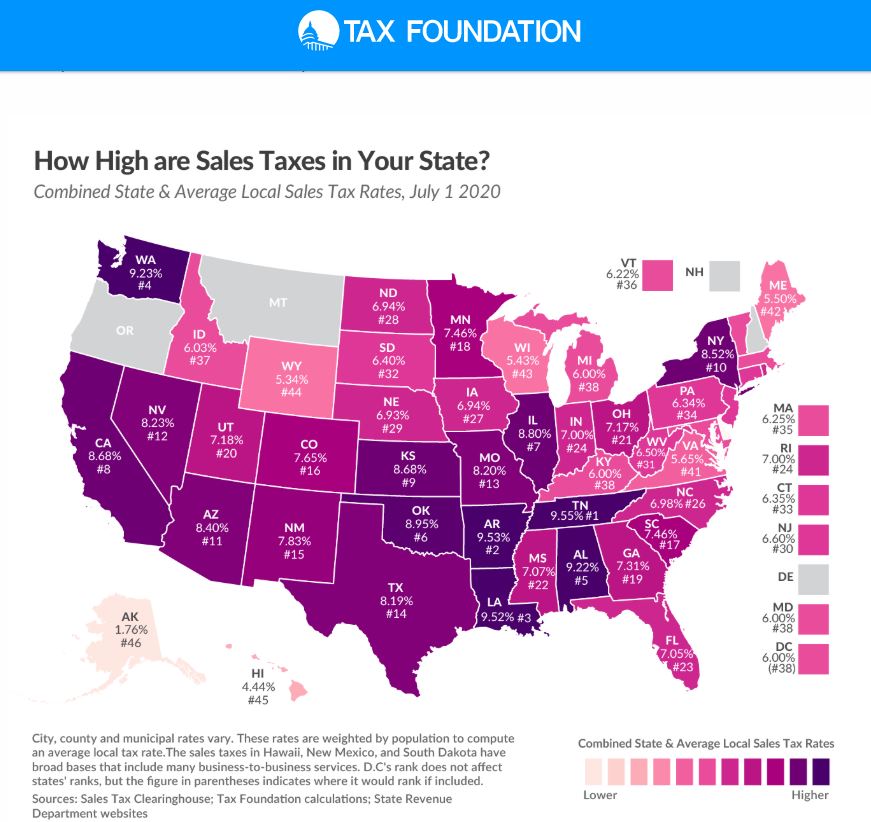

North Dakota Sales Tax Small Business Guide Truic

How High Are Property Taxes In Your State Tax Foundation

Equalization Planning County Of Meade

South Dakota Property Tax Calculator Smartasset

Kansas Has 9th Highest State And Local Sales Tax Rate The Sentinel

Shocking Low Property Taxes In South Dakota Are In This County

Property Tax South Dakota Department Of Revenue

Mchenry County North Dakota Home

Property Taxes By State Highest To Lowest Rocket Mortgage

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

City Sales Property Tax Welcome To The City Of Brandon Sd

Property Tax South Dakota Department Of Revenue

States With No Income Tax Explained Dakotapost

Property Taxes By County Interactive Map Tax Foundation

A Breakdown Of 2022 Property Tax By State

Property Taxes A Function Of Levies Home Value And Also Residential Growth

Are There Any States With No Property Tax In 2022 Free Investor Guide

Monday Map Property Taxes By County 2005 2009 Average Tax Foundation